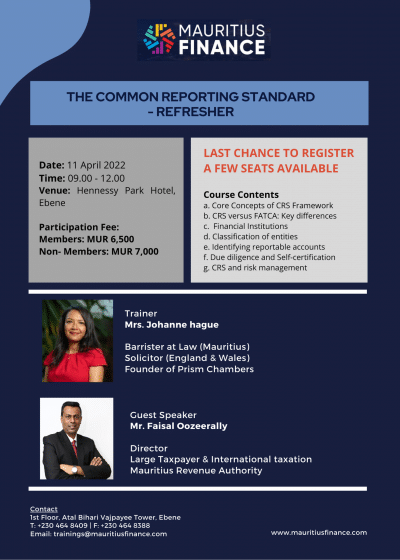

Mauritius Finance is hosting a training on Common Reporting Standard (CRS), designed for professionals of financial institutions.

The course’s objective is to refresh participants’ technical understanding of the Common Reporting Standard for Automatic Exchange of Information in Tax Matters (“CRS”) and to have a refresher on the key aspects of the CRS legislation and work through some case studies.

The training will be delivered by Mrs. Johanne Hague, Barrister at Law (Mauritius) and Solicitor (England & Wales). She is also the Founder of Prism Chambers.

The participation fee for this training is MUR 6,500 for our members and MUR 7,000 for non-members. ( MQA approved)

???? Date: 11 April 2022

????Venue: Hennessy Park Hotel, Ebene

⏰Time: 09.00- 12.00

For more information, send us an email on [email protected] or call us on 464 8409.